Trending Now

Hotels and Resorts

Vail Resorts Appoints Courtney Goldstein as Chief Marketing Officer

BROOMFIELD, Colo., April 1, 2024 /PRNewswire/ -- Vail Resorts, Inc. (NYSE: MTN) today announced that Courtney Goldstein has been appointed executive vice president and...

The World’s First and Biggest Chinese Wine Competition of International Standard...

MACAU, April 2, 2024 /PRNewswire/ -- Wynn will soon reveal the winners of the world's first and biggest Chinese wine competition of international standard...

Wyndham Enters Upscale Extended Stay with WaterWalk

"In the last year, guest demand for the extended stay segment reached record highs, which has been underscored by demand from owners and developers...

International Land Alliance, Inc. Announces Development and Sales Phase in Baja...

SAN DIEGO, April 2, 2024 /PRNewswire/ -- International Land Alliance, Inc. (OTCQB: ILAL) ("ILAL" or the "Company"), an environmentally sustainable real estate development company,...

Res

PERKINS RESTAURANT & BAKERY® IS IN ITS PRIME WITH WEEKLONG JUICY...

Enjoy prime rib entrées April 22-28 at an exceptional value

ATLANTA, April 22, 2024 /PRNewswire/ -- National Prime Rib Day is April 27, and Perkins Restaurant...

Wanglaoji acelera la expansión del mercado internacional con el lanzamiento de...

-Wanglaoji acelera la expansión del mercado internacional con el lanzamiento de la identidad de marca internacional WALOVI en Tailandia GUANGZHOU, China, 30 de marzo de...

KRYSTAL LAUNCHES KRYSTAL FLAVORED PROTEIN POWDER LINE

Bulk up your workout with the iconic flavor of Krystal – minus the calories

ATLANTA, April 1, 2024 /PRNewswire/ -- Krystal, the original quick-service restaurant chain...

There is a NEW Breadstick in Town! Red Lobster Unveils First-Ever...

Fan Favorite Cheddar Bay Biscuits Take New, Cheesy FormORLANDO, Fla., April 1, 2024 /PRNewswire/ -- Cheddar days are ahead for Cheddar Bay Biscuit lovers! Red...

Real Estate

Media

Westport International Food Week – a Big Weekend is Expected April...

The Westport Entertainment District - Where the Locals Go

Westport International Food Week ends on Sunday, April 21 April 23-29 in...

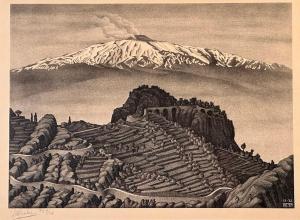

Neue Auctions’ online-only Art in Bloom auction, April 27th, will feature...

Lithograph on paper by Maurits Cornelis (M.C.) Escher (Dutch, 1898-1972), titled Castel Mola and Mount Edna, Sicily, signed, a rare...

Lucky Bears Pre-Launches New Board Game in Time for National Park...

Stacy and Annabelle Tornio - Lucky Bears Creators

Lucky Bears Game

Lucky Bears Packaging

Mother and Daughter Team Annabelle and Stacy Tornio Share...