Trending Now

Hotels and Resorts

Marriott Hotels and Manchester United’s Reimagined “Suite of Dreams” Revives the...

One lucky fan can stay overnight at Old Trafford for an immersive experience that celebrates the football, fashion, and culture of Manchester United's most...

VAYK Reported Over $2 Million Net Income for Fiscal Year 2023

DALLAS, April 2, 2024 /PRNewswire/ -- Vaycaychella, Inc. (OTC Pink: VAYK) ("VAYK") today announced that the company reported a net income of slightly over...

Pyramid Global Hospitality Ignites 2024 with an Expansion in Iconic Locales...

BOSTON and THE WOODLANDS, Texas, April 2, 2024 /PRNewswire/ -- Pyramid Global Hospitality is thrilled to announce a strong start to 2024 with the...

Global hospitality guest technology provider SONIFI amplifies its focus on growth...

MEXICO CITY, April 2, 2024 /PRNewswire/ -- Leading hospitality technology provider SONIFI is furthering its investment in business growth in Mexico, a rapidly expanding...

Res

Restaurant Brands International to Report First Quarter 2024 Results on April...

TORONTO, April 2, 2024 /PRNewswire/ - As previously announced, Restaurant Brands International Inc. ("RBI") (TSX: QSR) (NYSE: QSR) (TSX: QSP) will release its first quarter...

RED ROBIN SURPASSES $1 MILLION DONATION MILESTONE IN FIRST YEAR OF...

From April 1-30, Red Robin is making World Wish Month tastier than ever with the introduction of the new, limited-edition Make-A-Wish Dream Soda. Red...

Wingstop Inc. To Announce Fiscal First Quarter 2024 Financial Results On...

DALLAS, April 2, 2024 /PRNewswire/ -- Wingstop Inc. (NASDAQ: WING) today announced that it will host a conference call and webcast to discuss its...

TACO BELL® AND WILDFANG BREAK FASHION BOUNDARIES WITH ALL-NEW COVERALL COLLAB...

Taco Bell and WILDFANG join forces to unveil one-of-a-kind coverall, seamlessly blending style and functionality for a fashion-forward and utility-packed wardrobe essential.TLDR:

Taco Bell and WILDFANG...

Real Estate

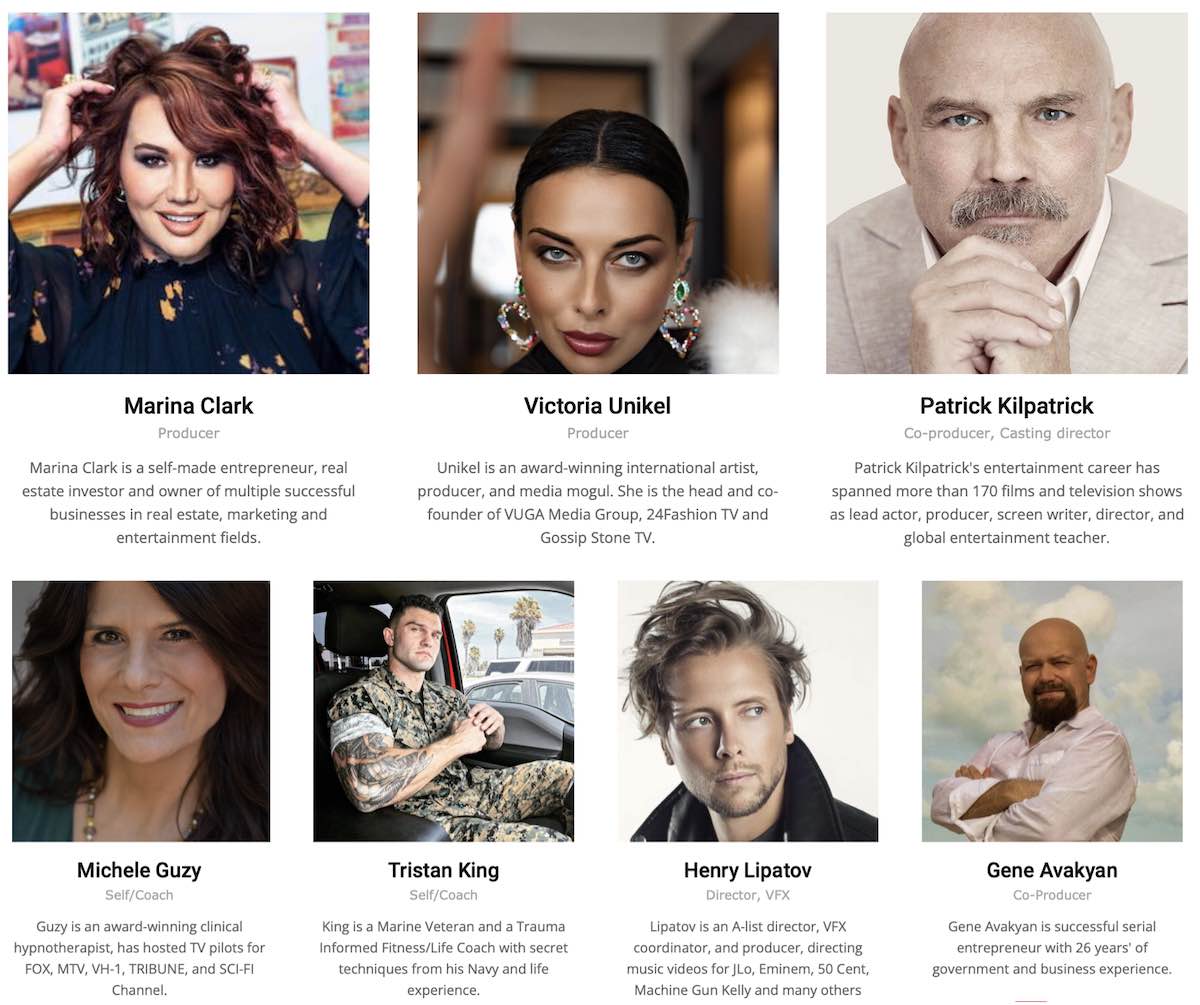

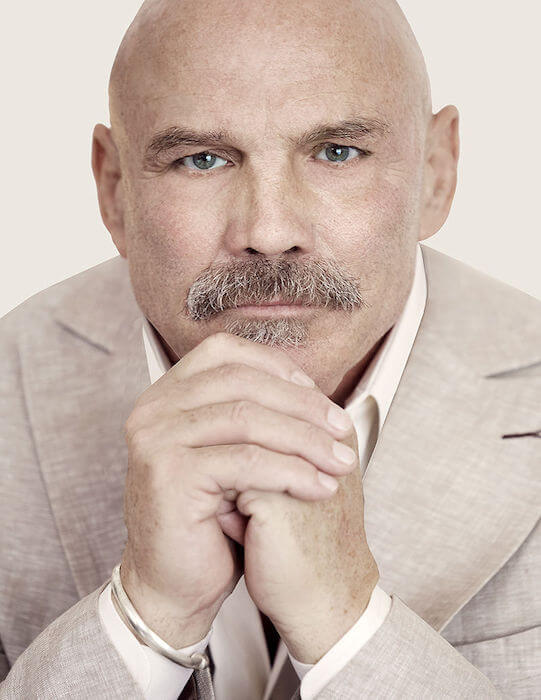

Media

UNESCO Culture|2030 Indicators’ Regional Preparatory Workshops train 24 countries to harness...

In a pivotal moment for global sustainable development, the UNESCO-EU Regional Preparatory Capacity-Building Workshop successfully gathered representatives from 24 countries,...

Ema, The Innovative AI-driven Health Assistant, is Transforming the First Crucial...

Five ways Ema is setting a new standard in health education and empowerment for women:

Ema is not just a technological...

Expert Urges Caution Amid Bitcoin Boom

Finance and investment expert Andrew Baxter

The Wealth Playbook: Your Ultimate Guide To Financial Security by Andrew Baxter

"Investors remain exposed to...