Trending Now

Hotels and Resorts

K9 Resorts Partners with Franchise Veteran as Pet Service Industry Surges,...

Industry Leading Dog Boarding and Daycare Franchise Expands Regional Growth with Seasoned EntrepreneurSALT LAKE CITY, April 23, 2024 /PRNewswire/ -- K9 Resorts Luxury Pet...

stayAPT Suites & Powerhouse Hotels Forge Partnership to Expand Presence with...

Six Locations to Break Ground in 2024

MATTHEWS, N.C., April 23, 2024 /PRNewswire/ -- stayAPT Suites, the innovative apartment-style hotel brand, is pleased to announce...

Vail Resorts Appoints Courtney Goldstein as Chief Marketing Officer

BROOMFIELD, Colo., April 1, 2024 /PRNewswire/ -- Vail Resorts, Inc. (NYSE: MTN) today announced that Courtney Goldstein has been appointed executive vice president and...

The World’s First and Biggest Chinese Wine Competition of International Standard...

MACAU, April 2, 2024 /PRNewswire/ -- Wynn will soon reveal the winners of the world's first and biggest Chinese wine competition of international standard...

Res

Post Time! Ford’s Garage Restaurants Named an Official Watch Location for...

Service station-themed eatery lines up limited-edition menus, merchandise giveaways and more racing excitement during the 10 Days of Derby countdown, April 24-May 4

TAMPA, Fla.,...

UNLIMEAT Pulled Pork Wrap Now Available at All Starbucks Stores in...

Starting April 16th, Starbucks launched UNLIMEAT pulled pork wrap as its newest plant-based option.

UNLIMEAT's Starbucks collaboration is the most recent in a series of collaborations...

PERKINS RESTAURANT & BAKERY® IS IN ITS PRIME WITH WEEKLONG JUICY...

Enjoy prime rib entrées April 22-28 at an exceptional value

ATLANTA, April 22, 2024 /PRNewswire/ -- National Prime Rib Day is April 27, and Perkins Restaurant...

Wanglaoji acelera la expansión del mercado internacional con el lanzamiento de...

-Wanglaoji acelera la expansión del mercado internacional con el lanzamiento de la identidad de marca internacional WALOVI en Tailandia GUANGZHOU, China, 30 de marzo de...

Real Estate

Media

SC7 hosts 2024 Expedition press event at S.C. State House

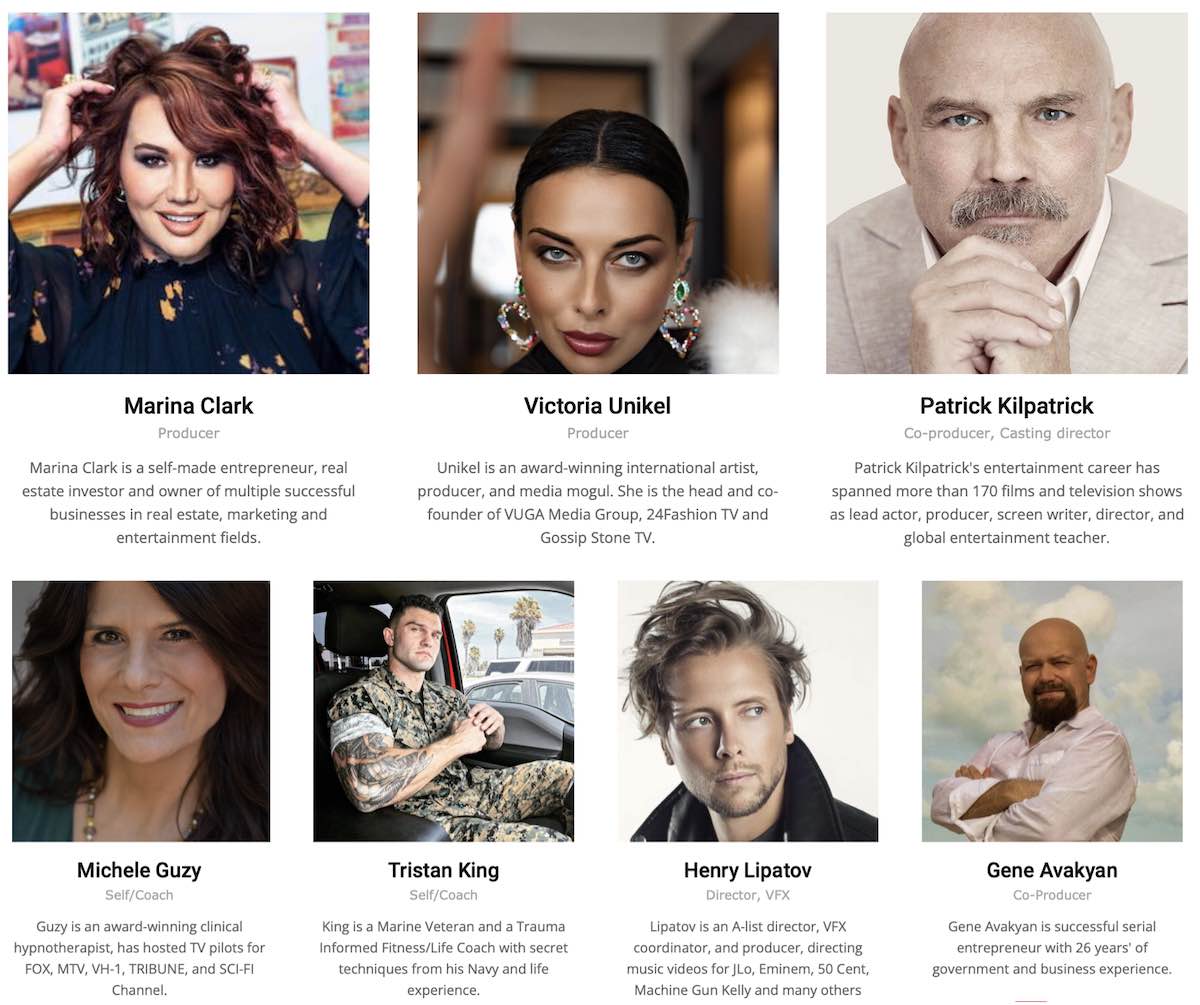

SC7 leader Dr. Tom Mullikin (white beard and blue ballcap) is pictured with SC7 documentary film crew and others off...

Margaret’s Couture Bridal Services and Wedding Salon EXCLUSIVE BRIDAL SHOW AT...

The Margaret’s Couture Bridal team of cleaning, preservation and alterations experts and artisans work closely with their clients for a...

Westport International Food Week – a Big Weekend is Expected April...

The Westport Entertainment District - Where the Locals Go

Westport International Food Week ends on Sunday, April 21 April 23-29 in...